Articles > Introduction to Valuing and Investing in Early-Stage Startups

Date: 28th of February 2017.

This article was also published on Medium and Quora.

Recently, I've been investigating alternative investment opportunities to further diversify my risky Bitcoin focused holdings. One such opportunity I discovered is investing in early-stage startups through equity crowdfunding platforms (more on this later in the article).

After some research, I realized that in addition to the lucrative potential return on investment, there are a multitude of other benefits: you can interact with highly motivated entrepreneurs, you can learn more about startups and the effort it takes to get funding, and most importantly it is a great way to brainstorm if you are looking for inspiration for your next startup venture. In this article, I will briefly go through the key concepts I came across while doing my research, as well as provide references to interesting resources on the subject - mostly for my own future reference.

Note: Investing in startups is extremely risky! According to published statistics, the most likely scenario is the full loss of invested money, excluding any tax relief you manage to secure.

Startup Funding Rounds

There are four common funding rounds that startups typically go through; Seed, Series A, Series B, and Series C. Each of these four rounds differ from the other by risk appetite and expected investable amount offered by the investors. Late stage funding rounds are less risky than early stage funding rounds and tend to involve much larger investment amounts.

In each round, the main focus of the founders and the investors is two things - the pre-money valuation and the total funding, combined, these two values decide how much equity the investor is granted and the final post-money valuation of the startup after the funding round is closed.

The first funding round is usually the seed round where the investment decision is mostly based on the idea and the team behind the startup instead of earnings or profitability. Active investors in seed rounds are Angel investors and early-stage VCs. The seed funding round can be skipped in favor of bootstrapping, whereby the founders use their own personal funds - or family and friends' funds - to fund the business.

If the startup successfully produces a viable product, then series A and series B funding rounds are used to raise investment for scaling the product across markets and improving the business's core talent and development. Active investors in Series A and Series B funding rounds are late stage VCs such as Sequoia Capital and Kleiner Perkins Caufield & Byers. Finally, Series C funding rounds are initiated if the startup is looking for further expansion, whether by acquiring another company or by merging with a competitor. There are more active investors in Series C late stage funding round, these include Hedge funds, Private Equity firms, and investment banks.

A startup funding round is an "up round" if the startup's value increases post-funding, conversely, a funding round is a "down round" if the startup's value decreases.

Basics of Startup Valuation

Valuing a startup is in essence an attempt at estimating the exit price and what the investor's return will be relative to how much equity his investment yielded. The most common exit for investors is a Trade Sale whereby a startup gets acquired by another company and the money is divided proportionally among shareholders; IPOs are another method of exit in which the company's shares get listed on a stock exchange and become tradable by the general public.

Factors that positively affect the value of a startup:

- Startup is operating in a hot market sector.

- Founding team's background and expertise is relevant to product.

- Useful product that has a revenue generation potential or is already generating profit.

- Investment interest - the more investors want to invest, the higher the valuation will be.

Factors that negatively affect the value of a startup:

- Startup is operating in a depressed market sector.

- Startup's market sector is saturated with very small margins.

- Non-functional product that still requires a significant cash investment.

- How desperate the founder is for money.

If the startup is focused on a hot market/industry and the investor believes that the market the startup is operating in will prosper and flourish, the investor's valuation will be more optimistic and he will be willing to take more risk. On the other hand, if the startup's market is depressed or saturated, the investor will be risk-averse and more conservative with his valuation.

One of the important factors that affect the valuation of a startup is the additional funding the startup will potentially seek after the closure of the current round, and if these subsequent funding rounds will result in equity dilution. Investors are more likely to invest in a startup if the startup has the potential to provide a quick exit to its investors with as little funding rounds as possible, reducing the risk of diminishing returns due to equity dilution. Similarly, a startup founder's main aim is to raise enough money to maximize his post-valuation net worth by sacrificing as little ownership as possible in exchange for a higher valued startup, the more funding rounds the startup goes through, the more equity the founder has to give up and the more diluted the equity pool becomes.

Equity simulator is an amazing tool that can help you visualise how funding rounds result in equity dilution. Also, check out this enlightening infographic courtesy of the people at bothsideofthetable.com.

Furthermore, early-stage and late-stage investors value startups differently. Once a startup starts turning in profit, which usually happens in late-stage, its valuation becomes less dependant on the startup's total funding and background, instead it shifts to being more dependant on the startup's EBTIDA, and growth rate. Furthermore, early-stage investors are risk takers and would be looking for a 5x - 8x return on their investment, late-stage investors on the other hand may only be targeting a 3x return.

Advanced Valuation and Analysis Techniques

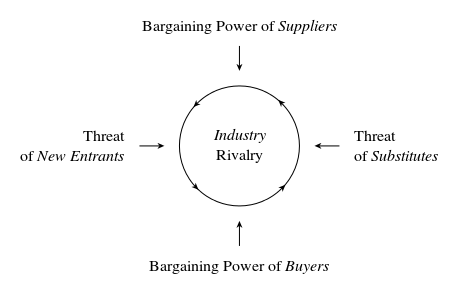

The previous section discussed what are fairly abstract concepts for valuing early-stage startups. The valuation process however can be made more rigorous and systematic by utilizing the many frameworks in Strategic Management literature. Strategic Management frameworks include the Business Model Canvas for analysing a startup's business model, Porter's Five Forces Analysis for analysing the attractiveness of the market sector a startup is operating in — template resources can be found at the end of this article, and the Value chain framework for analysing a startup's product delivery process starting with raw materials and ending with delivered product.

Strategic management isn't the only field that has contributed to startup valuation methods, Accounting literature has also provided quantitative frameworks for valuing startups which are admittedly used by senior VCs. Accounting frameworks include Discounted Cash Flow method which estimates the present value of a startup's future cash flows, and First Chicago Method which is an improvement over DCF that uses Valuation using multiples to estimate the discounted value under certain assumed scenarios where each scenario is given a probability.

Another popular accounting valuation method that is applicable to early-stage startups is the Comparable transactions method. The Comparables method can be used to value a startup by looking at the sale value of startups with a similar business model or industry. Though not usually effective for innovative high-tech startups that are creating their own market, the Comparables method is a solid tool for more traditional startups — you can use websites such as BizBuySell, BizQuest, BusinessesForSale, and RightBiz as a resource for sale prices to compare against.

Investing in Early-Stage Startups

Up until recently, due to regulation, startups looking for investment were restricted to the very competitive investment market exclusive to accredited investors such as Angel investors, and VC funds. However, new regulatory changes made it possible for startups to accept investment from public investors through equity crowdfunding as a means of expanding investment channels available to startups.

The exponential growth in early-stage startups seeking equity crowdfunding was set in motion by the passage of the JOBS Act in April 2012. The JOBS Act exempts small companies from having to register with the SEC when raising funds through certain types of small public offerings, making it possible for startups to give away equity ownership to the public in exchange for funding. There were no such restrictions in the UK, but HMRC looked to boost public investment by introducing SEIS, which grants extremely generous tax relief to early-stage startup investors including those investing through equity crowdfunding.

The following are some of the active equity crowdfunding platforms as of the publication of this article:

- Syndicateroom [UK]

- Seedrs [UK/Europe]

- Crowdcube [UK/Europe]

- Bnktothefuture [UK/Europe]

- Eureeca [UK/Middle East]

- Seedinvest [US]

- Fundersclub [US]

- Wefunder [US]

Information Resources

Below is a list of resources you can use to learn more about the startup investment market and keep up to date with the latest news:

- Quandal's Startups and VC Data Collection: an extremely insightful data-set specific to the US which you can explore using an interactive interface or access through Quandal's API. It includes data on Angel and VC deals aggregated by sector, VC deals aggregated by stage, and Angel exists.

- Angel Market Analysis Reports by University of New Hampshire: market analysis reports on the US Angel market dating back to 2002 — published biannually.

- Pitchbook's Newsletter and Reports: Pitchbook is a a paid service targeted at corporate and institutional users with a minimum subscription cost of around $6000; they do however offer a free newsletter full of startup and PE (Private Equity) news as well as free reports on the industry.

- IndieHackers: frequent interviews with startup founders with monthly revenue figures disclosed by each. Good resource if you are using the Comparables method to value a startup.

- Startups on Alltop: Alltop is a news site aggregator. The startups section contains the top news articles from the most popular news agencies that report on startups. Efficient way to get your daily startup news without having to visit each news website individually.

- Startup Failure Post-Mortems: A good way to learn about how startups fail, the blog contains extracts from founders and investors of failed startups.

- Startup Graveyard: Another curated resource of failed startups. If you are planning to invest in a startup, look up similar startups that have failed on Startup Graveyard and be cautious if the startup is facing similar issues!

If you know of an interesting resource that could be of use to startup founders or investors, send me an email. You can find my contact details on my Contact page.